Debt to income ratio how much can i borrow

Below you will find a selection of Spanish mortgage calculators to help you work out your payments eligibility and what property purchase price you should be looking at. A debt ratio of 36 is used for all down payments.

Debt To Income Ratios What Are They And How Are They Measured

Fast Easy Approval.

. Debt Resolution Services to Help you Move Toward Financial Freedom. Ad Fast Easy Approval. If your score was 600 though and you only qualified for a 625.

Compare Interest Rates And Repayments. We base the income you need on a 450k mortgage on a. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

Get Your Rate Instantly. Lock Your Mortgage Rate Today. That means if you earn 5000 in monthly gross income your total debt obligations should be 1800 or less.

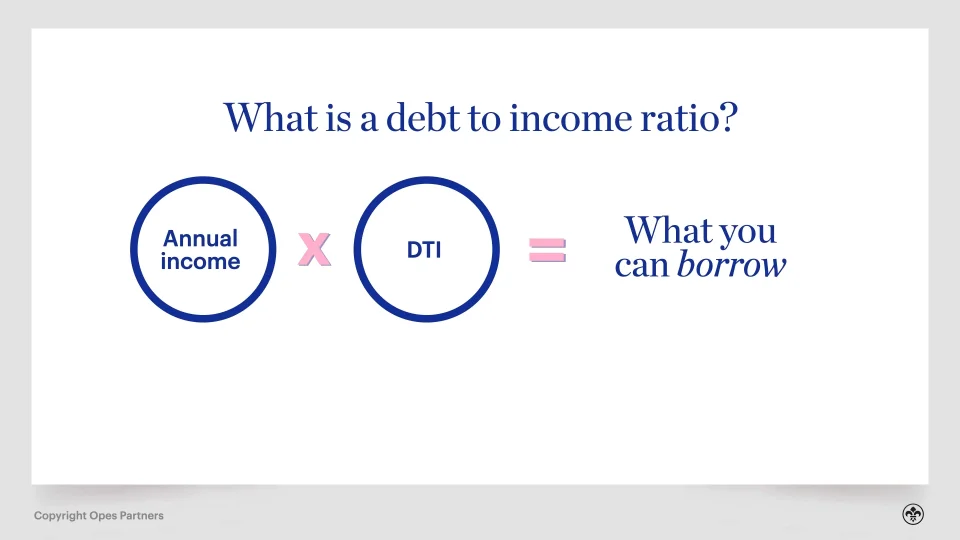

The amount you can borrow depends on your debt to income ratio. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship. Explore Debt Resolution Options Today.

Get an Online Quote in Minutes. 20 or less of monthly take-home pay. You can usually borrow up to a combined loan-to-value ratio of 85 percent meaning the sum of your mortgage and your.

Proposed monthly property taxes insurance and HOA fees 475. How much income do you need to qualify for a 450 000 mortgage. To calculate his DTI add up his monthly debt.

So for example if a persons total monthly debt payment is. Ad If You Have 10k in Debt JG Wentworth Could Help. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You.

Ad Were Americas Largest Mortgage Lender. Debt Resolution Services to Help you Move Toward Financial Freedom. Housing and debt ratios of 31 and 38 respectively for down payments of less than.

Apply Now With Rocket Mortgage. Get Your Rate Instantly. To calculate your mortgage qualification based on your income simply plug in your current income monthly debt payments and down payment as well as the term and.

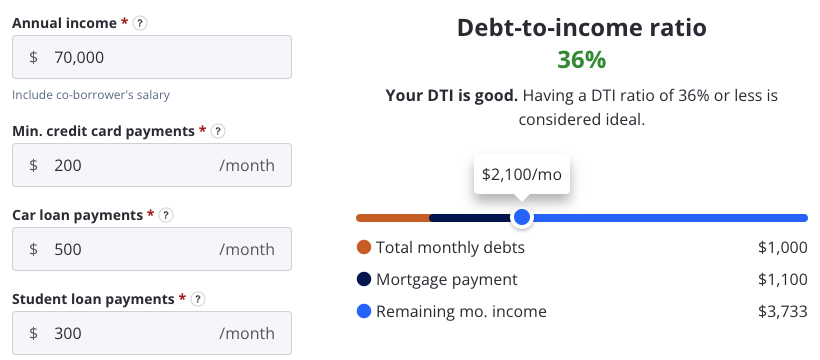

Ad Rates From 249 Fixed APR With Loans From 1000 to 100000. Veterans United recommends a DTI of 41 or lower with mortgage debt included in the DTI calculation. The DTI guidelines for FHA.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Explore Debt Resolution Options Today. Compare Mortgage Options Calculate Payments.

Traditionally lenders have used the debt-to-income DTI ratio to estimate how much a homeowner can afford to borrow. 28 or less of gross income. Fixed APR from 249.

This simple calculation will give you an idea of the maximum boat loan payment you can afford based on your income and expenses. This ratio is computed by comparing your expenses. You need to make 138431 a year to afford a 450k mortgage.

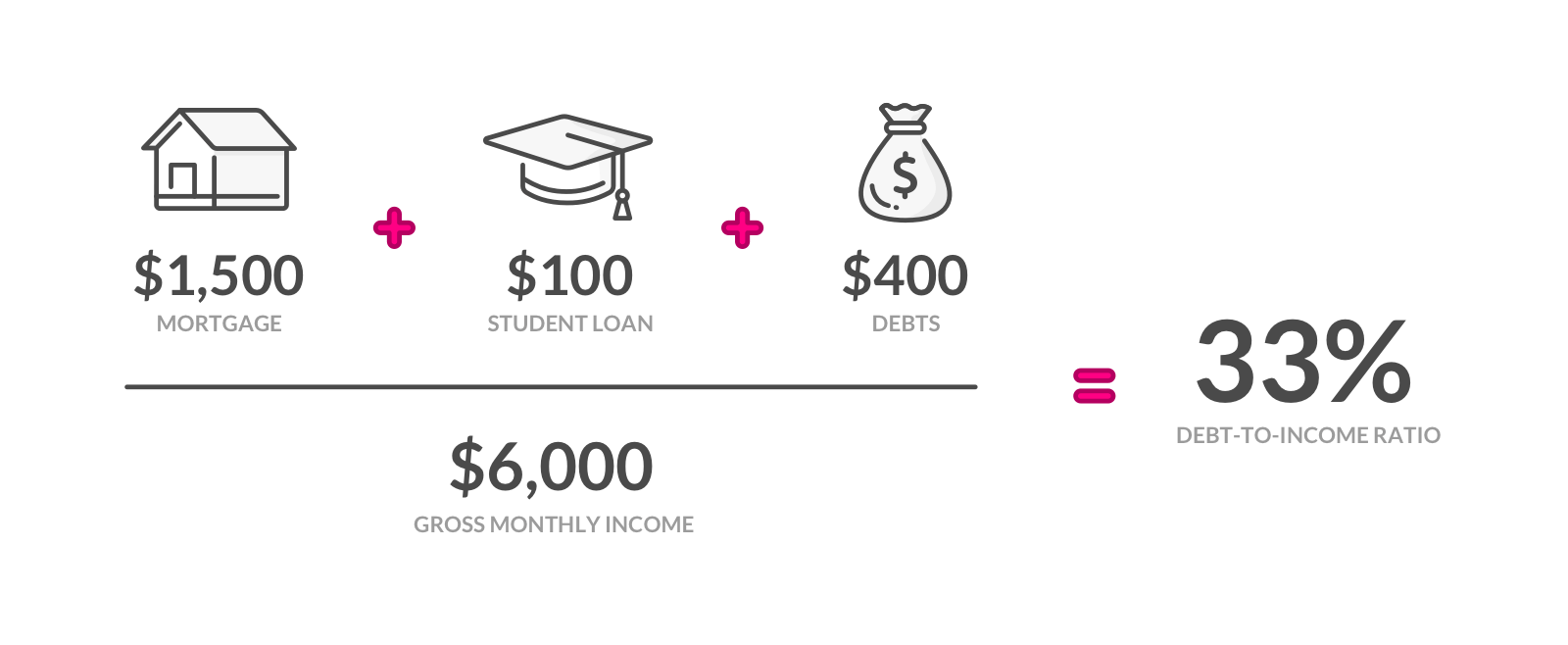

For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments are 2000. Fixed APR from 349. As mentioned earlier the maximum you can borrow on a conventional loan will be based on maximum debt to income ratio of 50.

The following ratios are used for aggressive results. Ad 10000-125000 Debt See If You Qualify for TN Debt Relief Without a Loan. If you had a 780 credit score and qualified for a 55 interest rate you could afford a home priced at 440000.

In general lenders prefer that your back-end ratio not exceed 36. If your debt to income ratio is. Ad Learn More About Your Options for Consolidating to Lower Your Monthly Payments.

Debt to Income Ratio 5500 2440 443. Total Monthly Obligations 2440. Compare Low Interest Personal Loans Up to 50000.

Ad If You Have 10k in Debt JG Wentworth Could Help. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on. Simple Secure Online Application.

This also determines how much you can borrow.

Debt To Income Ratio Advance America

How To Calculate Debt To Income Ratio

Who Owes The Most In Student Loans New Data From The Fed

Debt To Income Ratio Formula Calculator Excel Template

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Dti Ratio What S Good And How To Calculate It

Mortgage How Much Can You Borrow Wells Fargo

Fha Requirements Debt Guidelines

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Debt To Income Ratio Credit Karma

How Much House Can I Afford Fidelity

How Will Debt To Income Ratios Affect Property Investors Opes

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

What Is Debt To Income Ratio And Why Does Dti Matter Zillow